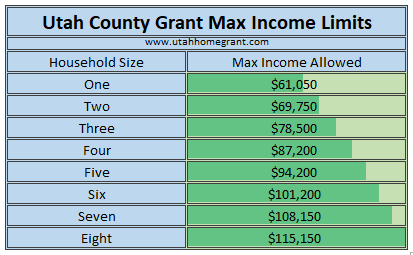

Utah County has a first time buyer program that will allow up to $40,000 in down payment assistance (DPA). The ‘Loan to Own’ down payment assistance program is available in all cities in Utah County except for Eagle Mountain, Fairfield, Alpine and Provo. The DPA can be used for down payment and closing costs, but no prepaid items such as interest, taxes and insurance. The final amount of the DPA will be determined by the type of mortgage you get and the home buyers closing costs. If you plan to sell the home within two years of closing this is not the assistance for you. If you do sell within two years of closing you may face a hefty $5,000 penalty in addition to paying the full amount of the DPA given to you back. If selling in within two years is a possibility you may want to consider either the Chenoa Fund or a Utah Housing loan.

Qualifications & Requirements:

- Min of 650 qualifying fico score

- Must be at least six months with current employer

- Maximum purchase price of $551,000

- First time home buyer only

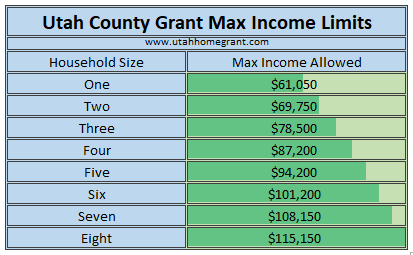

- Must be under maximum income limits

- $5,000 penalty if property sold within two years of closing

- 0% Interest no payments as long as you live in the home

- DPA must be paid back in full when the property is no longer the primary residence of the borrower(s)

The Utah based Chenoa Fund home buyer program offers a Repayable Second mortgage for anyone who qualifies and is over the income limits for the area. Saving money can be hard even if you are making above the median income, however you can still get help with your down payment. The Chenoa fund program will help you with a repayable second mortgage of 3.5% of the purchase price to help with the down payment of your FHA loan. This home buyer program will require the homebuyer to make payments and payoff the amount borrowed for the down payment. Only when the assistance is paid in full will the lien be removed from title.

- Purchase loans only

- Must qualify for an FHA loan

- 3.5% of purchase price available for down payment

- May be used anywhere in Utah

- No maximum income limits

- Owner occupied only

- 1-2 Unit property (additional restrictions apply)

- Min Fico Score 600

more…

Chenoa Fund Programs

Grant/Gift

Forgivable Soft Second

Repayable Second

The Utah based Chenoa Fund Grant is the favorite program available for most Utah home buyers. With this grant it does not matter if you are a first time buyer or have owned a home before. The grant will be completely forgiven shortly after closing. You are virtually receiving instant equity in your home. All programs with the Chenoa Fund Grant will require a homebuyer to qualify for an FHA first mortgage. When a home buyer is ready for closing they are able to receive 3.5% grant/gift of the purchase price of the home they are purchasing. Typically this will cover your entire down payment for the home. There are no geographical restriction so the grant is available for the entire state of Utah.

Qualification & Highlights:*

- Purchase loans only

- Must qualify for an FHA loan

- 3.5% of purchase price available for down payment

- May be used anywhere in Utah

- Must follow maximum income limits

- Owner occupied only

- 1-2 Unit property (additional restrictions apply)

- Min Fico Score 620

more

Chenoa Fund Programs

Grant/Gift

Forgivable Soft Second

Repayable Second

The Utah Housing HomeAgain Loan can be used by first time homebuyers or buyers that have previously owned a home. It allows for 2+ units as long as one is owner occupied. It is a great mortgage for anyone who does not have or does not want to put an initial down payment on a home. The DPA portion allows for up to 6% of the FHA first mortgage loan in the form of a fixed rate second lien to go towards down payment and/or closing costs.

Qualification and Requirements:*

- Must qualify for an FHA loan

- Minimum of 620 mid Fico score

- Purchase loans only

- 6% of the first loan amount is available for DPA

- May be used anywhere in Utah

- Maximum qualifying income limit $151,900

- No maximum purchase price

The Utah Housing Freddie Mac HFA Loan is not just a first time homebuyers program. This Utah down payment assistance (DPA) program allows for first time buyers and previous homeowners. It is also the only conventional Freddie Mac program they offer currently. To qualify you must have a minimum of a 700 fico score and be able to qualify for a conventional mortgage. The DPA is 6% (up to $25,000) of the first mortgage amount and can be used for down payment and/or closing costs. The property must be owner occupied and throughout the term of the UHC loan no portion of the property may be rented.

Qualification and Requirements:*

-

- Purchase loans only

- 6% (up to $25,000) of the first loan amount is available for DPA

- May be used anywhere in Utah

- Maximum income limits $134,100

- Debt ratio will be limited to a maximum of 50%

- Homebuyer Education required

- Single family units only

The Utah Housing First Time Buyer Program called FirstHome Loan is a great program for any first time buyer. The Utah housing First Time Buyer Program allows for up to 6% of the first mortgage loan as down payment assistance (DPA). This DPA is in the form of a 30 year fixed rate second loan. The DPA can be used for down payment and/or closing costs for the FHA first mortgage. You must be a first time buyer and be able to qualify for an FHA mortgage.

Qualification and Requirements:*

- Must qualify for an FHA loan

- No Portion of the property may be rented throughout the term of the UHC Loan

- 6% of the first loan amount is available for DPA

- Minimum of 660 Fico score

- No geographical restriction in Utah

- See below for income and max purchase price

Income and Purchase Price Limits for Utah Housing Loans

Loan Program

(FHA/VA Loan) |

Counties |

Family Size 1-2

Income Limit |

Family Size 3+

Income Limit |

Purchase Price Limit |

| FirstHome |

Beaver, Cache, Carbon, Daggett, Emery, Grand, Millard, Rich, Sevier, Uintah |

$108,500 |

$124,750 |

$510,900 |

| FirstHome |

Box Elder |

$109,900 |

$126,800 |

$608,500 |

| FirstHome |

Davis, Morgan, Summit, Wasatch, Weber |

$132,450 |

$154,550 |

$762,950 |

| FirstHome |

Duchesne, Garfield, Iron, Kane, Piute, San Juan, Sanpete, Wayne |

$130,200 |

$151,900 |

$513,200 |

| FirstHome |

Juab, Utah |

$130,800 |

$152,600 |

$613,400 |

| FirstHome |

Salt Lake |

$113,800 |

$130,850 |

$635,600 |

| FirstHome |

Tooele |

$113,800 |

$130,850 |

$635,600 |

| FirstHome |

Washington |

$109,900 |

$126,800 |

$608,500 |

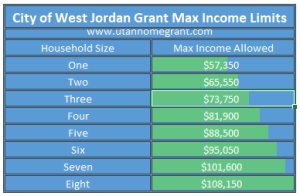

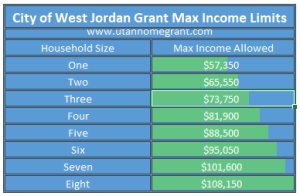

The City of West Jordan, Utah is providing up to $10,000 for first time homebuyers that purchase a home within West Jordan City limits. This grant may be applied to half of the required down payment and/or one-time closing costs. Funds are distributed on a first-come, first-serve basis. The home buyer must occupy the home for at least five (5) years following the purchase, any change in ownership or occupancy will require repayment of the grant funds. After five (5) years the grant is forgiven in full. If the home is sold or ceases to be occupied by the home buyer within the first five (5) years the lien is forgiven at a rate of 20% per completed year and the balance remaining will be due in full to the City.

Qualifications & Requirements:

- Home buyer must contribute a minimum of $2,500 cash out-of-pocket towards the purchase, these funds may NOT be gift funds

- Applicant must meet income qualifications and cannot have owned a home within the last 24 months

- Co-signers are not allowed

- Existing, new construction single-family homes, condos, and townhomes are permitted

- Housing debt cannot exceed 35% of the household monthly income and total debt cannot exceed 45% of the household monthly income

- Home must be owner occupied

- Applicant must attend and receive a completion certificate from a HUD approved homebuyers education class

- Visual inspection completed by the City for any safety or health concerns

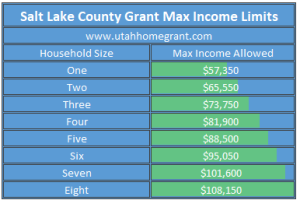

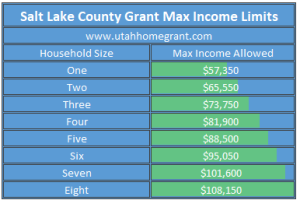

The “Own in Salt Lake County” first time home buyer program is a federally funded deferred loan/grant program that can provide up to $20,000 which can be applied to the 50% of required down payment. The goal of this government assistance program is to offer income-eligible households grant funds to help purchase a single-family home. Deferred loan funds shall be repaid in full by the recipient if the homeowner sells; exchanges or transfers title; decides to refinance for any other reason than to reduce their interest rate; or ceases to use the property as the primary residence. There are a limited amount of government grant funds available and they are distributed on a first-come, first-serve basis and take an average of 25 to 30 days to fund after a Letter of Commitment has been issued.

Qualifications & Requirements:

- No home ownership in the last three (3) years

- Home must be in a residential zone, single family residence only

- Max purchase price $522,500

- Applicants must contribute 50% of required down payment into the transaction. A minimum of $1,000 must be from applicants own personal liquid funds.

- Applicants must complete a home buyer education course and pre-purchase counseling

- Co-owner, co-borrower or co-signors are accepted, Community Development Corporation of Utah (CDCU) must be informed in writing if they are not on the initial “Own in Salt Lake County” application

- A visual assessment must be completed by CDCU or assigned agent for any safety or health concerns

- Income restrictions apply

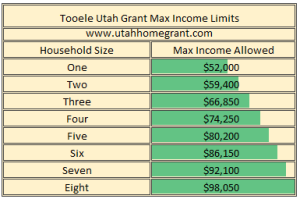

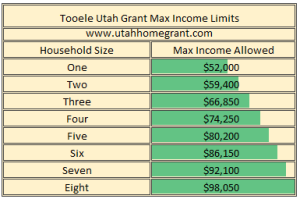

The Tooele County Housing Authority (TCHA) helps qualified first time home buyers purchase a home by providing a federally funded loan of up to $10,000 to assist with down payment and/or closing costs. Loans are dispersed on a first come, first serve basis and can be applied to the purchase of a single-family home, condo, cooperative unit, or combination of manufactured housing and lot.

Qualifications & Requirements:

- No homeownership in the last three (3) years

- Applicant must contribute $1,000 of own money

- Applicant must attend a Housing and Urban Development (HUD) approved homebuyer education class and provide a certificate of completion

- A home inspection completed by a Utah licensed home inspector for health and safety concerns and lead-based paint for homes built prior to 1978

- Home must be located in Tooele County

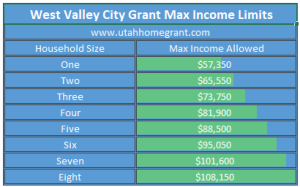

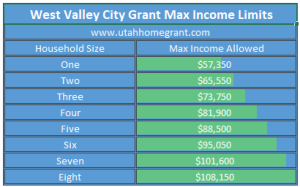

If you are a Utah first time home buyer looking to buy a home in West Valley City Utah a $14,999 government grant program can help make buying a home a little easier. The West Valley Down Payment Assistance Program (DAP) offers funds to help low to moderate income families realize their dream of owning a home. The funds are provided by HOME funds and the CDBG and may be used for down payment and/or closing costs.

This West Valley grant does not have to be repaid so long as the homeowner resides in the home for at least five (5) years and doesn’t refinance, transfer title, or sell the home. Funding is limited for the down payment assistance program and is distributed on a first come, first serve basis.

Qualifications Requirements:

- Buyer must contribute a minimum of $4,000 towards the purchase of the home. $2,000 can be gifted by a family member and $2,000 must come from the buyer.

- Maximum purchase price not to exceed $387,000

- A Grant Technician will review the application and occupancy status

- Home must pass a lead-based paint and safety inspection

- An eligible home will be vacant, owner occupied, and/or not used as a rental in the last six (6) months

VERY IMPORTANT: Applicant must complete a First Time Home Buyer class, receive a certificate AND be approved with a state approved lender for a first mortgage BEFORE an offer is made on a home. Failure to meet these requirements will result in the grant being denied.